From financial center to key FinTech Hub

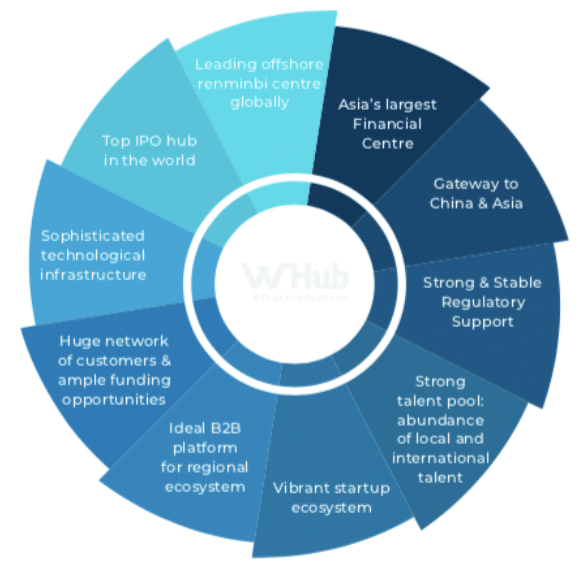

WHub, a strategic partner of Crunchbase, recently launched their FinTech Whitepaper presenting key findings and facts on the Hong Kong ecosystem. Hong Kong is usually known for its position as a leading global Financial Hub. However, over the past 3 years, Hong Kong has been transitioning from a leading Financial center to a key FinTech Hub.

Contributing factors include:

- Strength of its financial sectors

- A strong talent pool

- Hong Kong’s position as a gateway to regional and Mainland China markets

- Regulatory framework

- Its safeguard for intellectual property and data protection

- A growing and diverse ecosystem

- Recent FinTech startups that have raised funding

- Supportive community builders

- FinTech associations and events

- Corporate – startup collaboration

- Regulators and government support

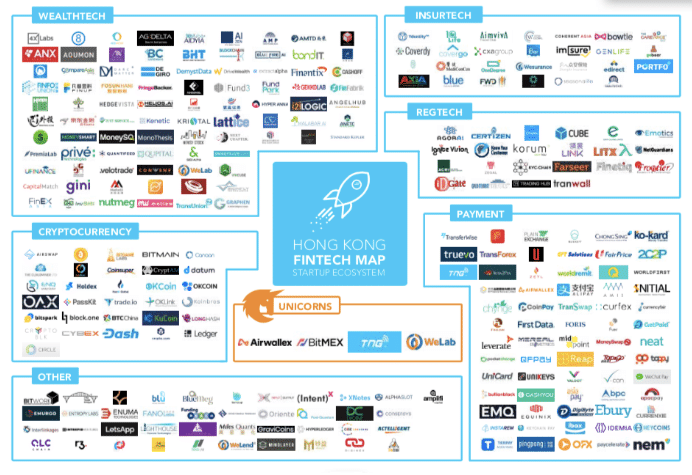

FinTech startup activity and unicorns

Startups are defined by disruption and growth. Hong Kong has seen extensive activity in its startup ecosystem, with an estimated 3,000+ startups. This can be attributed to (among other factors) its unique positioning that allows fast and high scalability. Also, products can be tested quickly due to its hyper-connected population. As a small market, it forces startups to think globally from day one. There is a strong sense of genuine support and solidarity within the ecosystem, which further boasts HK’s attractiveness.

Specifically, the city now boasts the evolution of nine homegrown Unicorns, of which four are in the FinTech sector:

- AirWallex (raised US$202 million)

- BitMEX (trading history of over US$34 billion worth of Bitcoin since its launch)

- The TNG FinTech Group (raised US$115 million in Series A, the largest series A investment for a FinTech company)

- WeLab (raised US$425 million)

The Whitepaper also offers readers an in-depth look at the various FinTech sectors and their underlying technologies and applications within the market.

Hong Kong FinTech Map: Illustrating 290 HK FinTech startups according to their relative sectors

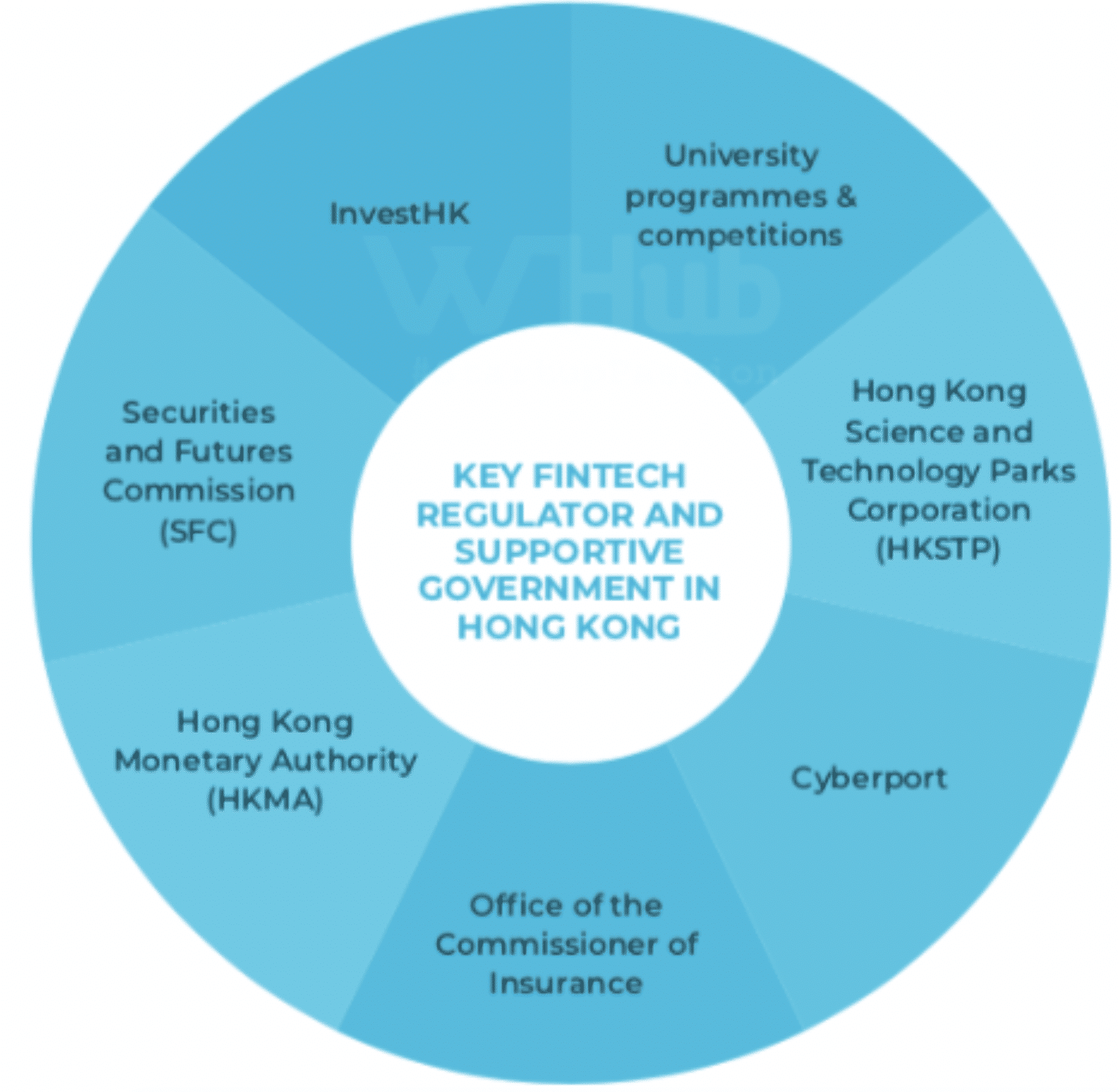

Support initiatives for FinTech

Hong Kong’s active FinTech sector can be attributed to the city’s supportive ecosystem with the HKSAR Government also gearing up for the evolution of the FinTech era. There are various government programs, regulations and policies that have been guiding these government initiatives to further develop Hong Kong as a sustainable and powerful FinTech Hub. In this regard, on September 12, 2018, Chief Executive of Hong Kong, Ms. Carrie Lam mentioned “FinTech is a key technology area to focus on and invest in”. Hong Kong has been recognized as a leading global financial center for some time now. Recently, the corresponding regulatory measures have also recognized the importance of FinTech innovation. There have been several virtual banking licenses authorized by the Hong Kong Monetary Authority and more are expected to follow soon.

Government initiatives in the GBA

There have also been many government initiatives with respect to the GBA, an economic cluster that includes the 11 cities of the Guangdong-Hong Kong-Macau regions. These initiatives will promote growth, innovation, and better relationships between countries and within regions. The synergy is intended to combine Hong Kong’s financial system together with China’s human capital resources, technological ecosystem, efficient supply chains and large-scale consumer markets.

There have been several initiatives such as The Greater Bay Area Homeland Development Fund, which was initiated by Hong Kong’s corporate community for continued technology development and innovation in the region. With a capital volume of over HK$100 Billion, it will provide a financial boost to technology companies operating in the GBA. This platform is also expected to include information about IP and patents. The development fund will also assist certain Hong Kong’s industries to set up operations and scale in the GBA. However, in order to enjoy the vast market opportunities in the GBA, there are certain challenges that must be addressed and certain restrictions that must be eased including:

- Regulation of financial services in the GBA to provide more seamless banking experiences for corporates and individuals

- Cross Border Payments are still challenging – perhaps need to consider a Cross Border FinTech payment solution

- Need of infrastructure support – including medical and education world-class facilities – for the region to be able to promote and attract talent and innovation

- Authorities are evaluating the tax incentives currently offered in the GBA, in comparison to those offered by special economic zones in China, in order to attract hi-tech talent

Corporate initiatives and community builders

In addition to government initiatives, the Whitepaper presents the dynamic FinTech synergies that are unfolding with corporates, startups and incumbents in various financial and technological sectors. These parties have a symbiotic relationship; their various sets of competitive advantages and challenges create win-win collaborations and partnerships in the dynamic FinTech arena. Similarly, startups are also strongly supported by community builders that unite together with startups to drive the FinTech ecosystem. Accordingly, as this is an integral part of the development of a startup, WHub’s Whitepaper contains an extensive list of community builders (entrepreneurs, industry experts and investors).

Click here to download the full whitepaper.

Media Enquiries can be sent to Sakshi Kothari, sakshi@whub.io

About WHub

WHub.io, Hong Kong’s biggest startup community and power connector, is a platform showcasing more than 3,000 startups to accelerate their business through making meaningful connections.

The WHub vision is based on 3 main pillars:

- Connect: Connecting startups with startup ecosystem to forge game-changing partnerships; enable startups to build their team by posting jobs and contacting talent directly.

- Empower: Favoring startups with exclusive WHub Perks to resources and events; access to inspiring and thoughtful connections and events through our curated event calendar.

- Educate: Issuing Startup Toolboxes to help startups scale beyond their home countries; organising events and supporting global conferences; curating the latest news in the ecosystem.

WHub helps startups unleash their full potential. We believe in the combination of startup agility and corporate power.

WHub’s FinTech Whitepaper presents key findings and facts as well as a comprehensive analysis of the contributing factors in the ecosystem that have solidified Hong Kong’s position as a leading global Financial Hub and its evolution into a competitive FinTech Hub.

WHub launched the V.3 FinTech Whitepaper on Wednesday, March 27, following the announcement that the HK Monetary Authority granted banking licences under the Banking Ordinance to Livi VB Limited, SC Digital Solutions Limited and ZhongAn Virtual Finance Limited.

The Whitepaper was presented by WHub/AngelHub co-founder, Karena Belin and was preceded by a panel discussion moderated by WHub/AngelHub co-founder, Karen Contet Farzam. The panellists all expressed that the HK Ecosystem is thriving, vibrant and accelerating to new levels.